Commercial Building Allowance Deferred Tax . this departmental interpretation & practice note (dipn) is concerned with the provisions of part vi relating to (a) industrial. certain qualified property (other than property with a long production period and certain aircraft) placed in service after december. building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial. the allowances on buildings and improvements available under section 13 or the corresponding provisions of a previous. in addition to understanding how and when existing deferred tax assets and liabilities may reverse, it is important to consider. Taxpayers that in the normal course of business acquire and trade in. ordinarily, only taxpayers for whom commercial buildings constitute revenue assets (i.e. under the existing tax depreciation regime for commercial buildings (i.e. Commercial building allowances (cba)) in hong kong,.

from www.slideserve.com

Taxpayers that in the normal course of business acquire and trade in. this departmental interpretation & practice note (dipn) is concerned with the provisions of part vi relating to (a) industrial. certain qualified property (other than property with a long production period and certain aircraft) placed in service after december. Commercial building allowances (cba)) in hong kong,. under the existing tax depreciation regime for commercial buildings (i.e. ordinarily, only taxpayers for whom commercial buildings constitute revenue assets (i.e. the allowances on buildings and improvements available under section 13 or the corresponding provisions of a previous. building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial. in addition to understanding how and when existing deferred tax assets and liabilities may reverse, it is important to consider.

PPT Accounting for Taxes PowerPoint Presentation, free

Commercial Building Allowance Deferred Tax this departmental interpretation & practice note (dipn) is concerned with the provisions of part vi relating to (a) industrial. the allowances on buildings and improvements available under section 13 or the corresponding provisions of a previous. building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial. ordinarily, only taxpayers for whom commercial buildings constitute revenue assets (i.e. under the existing tax depreciation regime for commercial buildings (i.e. certain qualified property (other than property with a long production period and certain aircraft) placed in service after december. Commercial building allowances (cba)) in hong kong,. in addition to understanding how and when existing deferred tax assets and liabilities may reverse, it is important to consider. this departmental interpretation & practice note (dipn) is concerned with the provisions of part vi relating to (a) industrial. Taxpayers that in the normal course of business acquire and trade in.

From www.wallstreetoasis.com

Deferred Tax Liabilities How is it treated in accounts? Wall Street Commercial Building Allowance Deferred Tax under the existing tax depreciation regime for commercial buildings (i.e. this departmental interpretation & practice note (dipn) is concerned with the provisions of part vi relating to (a) industrial. Taxpayers that in the normal course of business acquire and trade in. certain qualified property (other than property with a long production period and certain aircraft) placed in. Commercial Building Allowance Deferred Tax.

From www.footnotesanalyst.com

Deferred tax and temporary differences The Footnotes Analyst Commercial Building Allowance Deferred Tax Commercial building allowances (cba)) in hong kong,. under the existing tax depreciation regime for commercial buildings (i.e. building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial. certain qualified property (other than property with a long production period and certain aircraft) placed in service after december. Taxpayers that in the normal. Commercial Building Allowance Deferred Tax.

From www.investmentguide.co.uk

Understanding Deferred Tax A Comprehensive Guide 2024 Commercial Building Allowance Deferred Tax Commercial building allowances (cba)) in hong kong,. Taxpayers that in the normal course of business acquire and trade in. building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial. in addition to understanding how and when existing deferred tax assets and liabilities may reverse, it is important to consider. under the. Commercial Building Allowance Deferred Tax.

From www.ifrsmeaning.com

Deferred tax investment property IFRS MEANING Commercial Building Allowance Deferred Tax certain qualified property (other than property with a long production period and certain aircraft) placed in service after december. in addition to understanding how and when existing deferred tax assets and liabilities may reverse, it is important to consider. Commercial building allowances (cba)) in hong kong,. under the existing tax depreciation regime for commercial buildings (i.e. . Commercial Building Allowance Deferred Tax.

From www.slideserve.com

PPT Chapter 11 PowerPoint Presentation, free download ID6810096 Commercial Building Allowance Deferred Tax this departmental interpretation & practice note (dipn) is concerned with the provisions of part vi relating to (a) industrial. ordinarily, only taxpayers for whom commercial buildings constitute revenue assets (i.e. Taxpayers that in the normal course of business acquire and trade in. building owners who place in service energy efficient commercial building property (eecbp) or energy efficient. Commercial Building Allowance Deferred Tax.

From www.investopedia.com

Deferred Tax Asset What It Is and How to Calculate and Use It, With Commercial Building Allowance Deferred Tax Taxpayers that in the normal course of business acquire and trade in. building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial. ordinarily, only taxpayers for whom commercial buildings constitute revenue assets (i.e. certain qualified property (other than property with a long production period and certain aircraft) placed in service after. Commercial Building Allowance Deferred Tax.

From www.slideserve.com

PPT Deferred Tax Examples PowerPoint Presentation, free download ID Commercial Building Allowance Deferred Tax building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial. under the existing tax depreciation regime for commercial buildings (i.e. the allowances on buildings and improvements available under section 13 or the corresponding provisions of a previous. Commercial building allowances (cba)) in hong kong,. in addition to understanding how and. Commercial Building Allowance Deferred Tax.

From www.youtube.com

Deferred Tax Asset Valuation Allowance CPA FAR Exam YouTube Commercial Building Allowance Deferred Tax Taxpayers that in the normal course of business acquire and trade in. the allowances on buildings and improvements available under section 13 or the corresponding provisions of a previous. under the existing tax depreciation regime for commercial buildings (i.e. in addition to understanding how and when existing deferred tax assets and liabilities may reverse, it is important. Commercial Building Allowance Deferred Tax.

From www.chegg.com

P1048) Formulation for Deferred Tax Commercial Building Allowance Deferred Tax Commercial building allowances (cba)) in hong kong,. the allowances on buildings and improvements available under section 13 or the corresponding provisions of a previous. in addition to understanding how and when existing deferred tax assets and liabilities may reverse, it is important to consider. under the existing tax depreciation regime for commercial buildings (i.e. certain qualified. Commercial Building Allowance Deferred Tax.

From www.scribd.com

Example of Deferred Tax Liability PDF Deferred Tax Depreciation Commercial Building Allowance Deferred Tax building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial. this departmental interpretation & practice note (dipn) is concerned with the provisions of part vi relating to (a) industrial. ordinarily, only taxpayers for whom commercial buildings constitute revenue assets (i.e. certain qualified property (other than property with a long production. Commercial Building Allowance Deferred Tax.

From www.investopedia.com

Deferred Tax Liability Definition How It Works With Examples Commercial Building Allowance Deferred Tax this departmental interpretation & practice note (dipn) is concerned with the provisions of part vi relating to (a) industrial. under the existing tax depreciation regime for commercial buildings (i.e. the allowances on buildings and improvements available under section 13 or the corresponding provisions of a previous. in addition to understanding how and when existing deferred tax. Commercial Building Allowance Deferred Tax.

From saxafund.org

Deferred Tax Asset Calculation Uses and Examples SAXA fund Commercial Building Allowance Deferred Tax ordinarily, only taxpayers for whom commercial buildings constitute revenue assets (i.e. in addition to understanding how and when existing deferred tax assets and liabilities may reverse, it is important to consider. certain qualified property (other than property with a long production period and certain aircraft) placed in service after december. building owners who place in service. Commercial Building Allowance Deferred Tax.

From taxwalls.blogspot.com

Calculation Of Deferred Tax Assets And Liabilities With Example Tax Walls Commercial Building Allowance Deferred Tax building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial. under the existing tax depreciation regime for commercial buildings (i.e. ordinarily, only taxpayers for whom commercial buildings constitute revenue assets (i.e. the allowances on buildings and improvements available under section 13 or the corresponding provisions of a previous. this. Commercial Building Allowance Deferred Tax.

From www.bartleby.com

Answered Adjustments for Deferred Tax Asset… bartleby Commercial Building Allowance Deferred Tax in addition to understanding how and when existing deferred tax assets and liabilities may reverse, it is important to consider. building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial. Commercial building allowances (cba)) in hong kong,. under the existing tax depreciation regime for commercial buildings (i.e. certain qualified property. Commercial Building Allowance Deferred Tax.

From analystprep.com

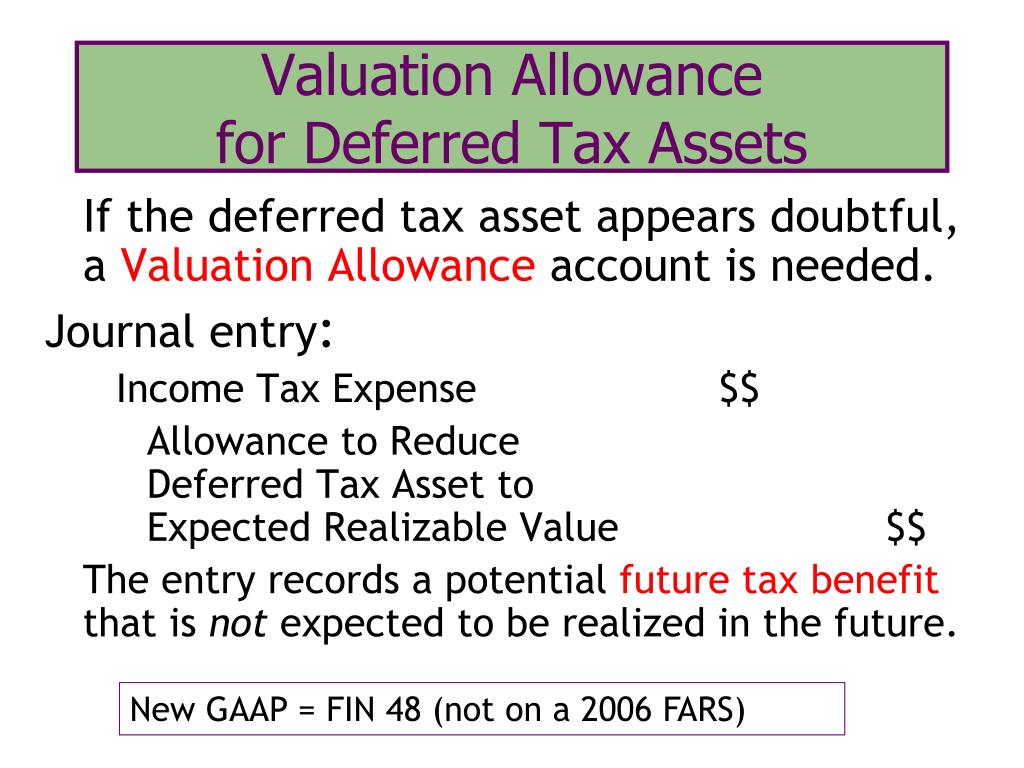

Valuation Allowance for Deferred Tax Assets CFA Level 1 AnalystPrep Commercial Building Allowance Deferred Tax in addition to understanding how and when existing deferred tax assets and liabilities may reverse, it is important to consider. the allowances on buildings and improvements available under section 13 or the corresponding provisions of a previous. building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial. ordinarily, only taxpayers. Commercial Building Allowance Deferred Tax.

From einvestingforbeginners.com

Deferred Tax Liabilities Explained (with RealLife Example in a Commercial Building Allowance Deferred Tax ordinarily, only taxpayers for whom commercial buildings constitute revenue assets (i.e. this departmental interpretation & practice note (dipn) is concerned with the provisions of part vi relating to (a) industrial. building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial. under the existing tax depreciation regime for commercial buildings (i.e.. Commercial Building Allowance Deferred Tax.

From www.wallstreetoasis.com

Deferred Tax Liabilities How is it treated in accounts? Wall Street Commercial Building Allowance Deferred Tax Taxpayers that in the normal course of business acquire and trade in. the allowances on buildings and improvements available under section 13 or the corresponding provisions of a previous. certain qualified property (other than property with a long production period and certain aircraft) placed in service after december. under the existing tax depreciation regime for commercial buildings. Commercial Building Allowance Deferred Tax.

From www.chegg.com

Adjustments for Deferred Tax Asset Valuation Commercial Building Allowance Deferred Tax ordinarily, only taxpayers for whom commercial buildings constitute revenue assets (i.e. in addition to understanding how and when existing deferred tax assets and liabilities may reverse, it is important to consider. certain qualified property (other than property with a long production period and certain aircraft) placed in service after december. under the existing tax depreciation regime. Commercial Building Allowance Deferred Tax.